Inflation heats up, rate cuts on hold

Inflation in the US rose higher than expected in March. The Consumer Price Index (CPI) hit 3.5% year-over-year, exceeding the market’s prediction of 3.4%. Core CPI, excluding food and energy, also came in hotter than anticipated, reaching 3.8% compared to the expected 3.7%.

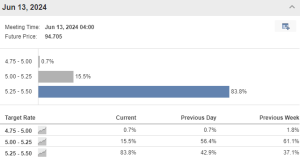

This unexpected inflation surge dampened investors’ hope for an interest rate cut in June. Before the CPI report, there was a good chance (over 56%) of a rate cut in June. However, now the future market suggests that the possibility has shrunk significantly, down to just 15%.

The change in rate cut expectations impacted the equity market. Both the S&P 500 and Nasdaq Composite closed lower. US Bond yields also jumped, with the 10-year Treasury yield exceeding 4.5% again and the 2-year yield approaching 5% – its highest level in 13 months. The market is pushing the expectation of the easing cycle to start later this year which lays elevated pressure on equity valuation.

Image source: Investing.com as at 11 April 2024

Rising shelter and gasoline prices drive inflation

Increased costs for housing and gasoline were the main drivers behind the March inflation rise, contributing to over half of the overall CPI increase. Shelter costs, in particular, were the biggest contributor to core CPI growth, rising 5.7% year-over-year and accounting for more than 60% of the core CPI’s 12-month increase.

Energy prices remain volatile

Energy prices showed significant swings in the past several months. The energy index increased 1.1% in March, following a larger 2.3% increase in February. Gasoline prices were a key contributor, rising 1.7% in March. Electricity prices also climbed slightly, while natural gas prices remained flat. Looking ahead, we expect energy prices to stay volatile and potentially higher due to rising tensions in the Middle East and Russia, which have increased risk premiums for oil.

For more information, please contact Andrew Davies.