The RBA Rate Hike

The new Governor Michele Bullock handed down her first rate hike lifting the interest rate from 4.1% to 4.35% at the Reserve Bank of Australia’s (RBA) November meeting, as broadly expected by the market. However, the statement released by the RBA was dovish, which surprised the market. The board acknowledged in the statement that the cumulative interest rate raises are flowing through to the economy, albeit more slowly than expected, as evidenced by negative real incomes and weakening consumption growth. The RBA reiterated the importance of controlling inflation and stated that it will continue to take a data-dependent approach.

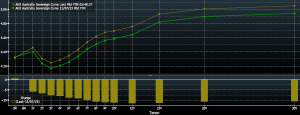

The dovish view from the RBA contributed to a downward shift in the Australian Treasury Yield Curve, which drove the AUD to trade lower. In the chart below, the yellow line represents the Australian Treasury Yield Curve prior to the November RBA interest rate decision, and the green line represents the post-decision curve. The bars represent the difference between the two lines in basis points. Yields and prices move in opposite directions and one basis point equals 0.01%.

The AZ Sestante team will continue to pay close attention to the evolving market condition and potential effects on the portfolio.

In addition, we swapped the Pimco Diversified Fixed Income fund for the Pimco Global Bond fund. This trade was made to ensure we maintained our exposure to international fixed income at current levels post the swap of Macquarie for Perpetual and to slightly increase the duration of the portfolio.

Image source: AZ Sestante, Bloomberg

For more information, please contact Andrew Davies.